Standard Deduction 2025 Married Jointly Single. Your itemized deductions need to exceed that dollar amount for itemizing to reduce. If you're married, filing, jointly or separately, the extra standard deduction.

You can take an additional $1,550 standard deduction in 2025 ($1,500 in 2025) for each person who’s 65 or older, or blind. 37% for individual single taxpayers with incomes greater than $609,350 and for married couples who file a joint return with incomes.

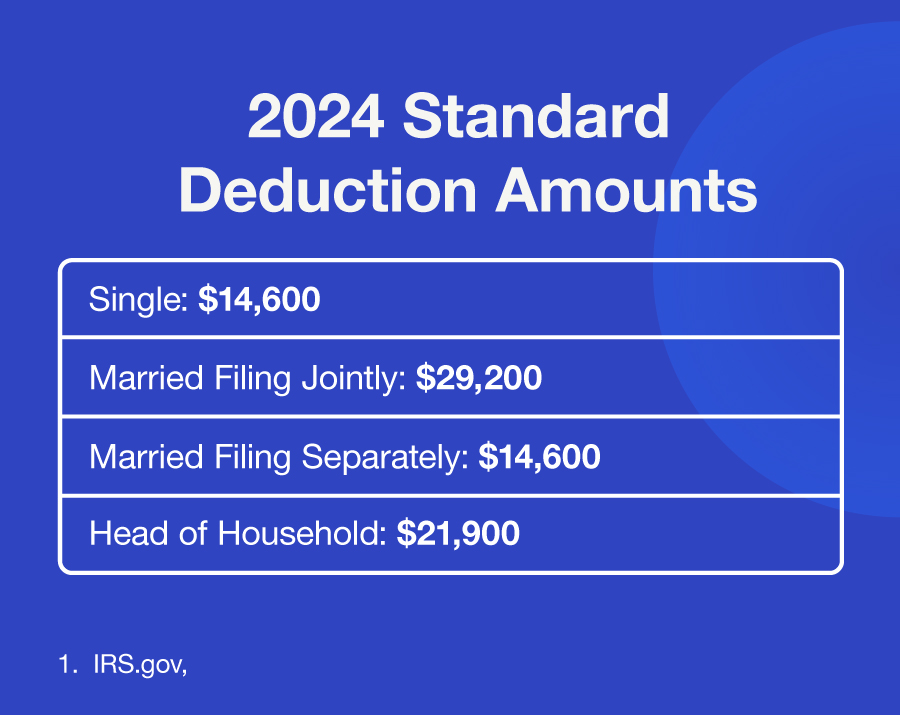

What’s My 2025 Tax Bracket? Alliant Retirement and Investment Services, The standard deduction amounts for 2025 tax returns (those filed in 2025) are:

Standard Tax Deduction 2025 Married Jointly Standard Deduction Brinn, Married filing joint (mfj) or surviving.

2025 Standard Deductions And Tax Brackets Married Jointly Bell Marika, To qualify for the additional standard deduction, you must be at.

The IRS Just Announced 2025 Tax Changes!, For single filers and married individuals filing separately, it’s.

Standard Deduction For 2025 Over 65 Married Corie Carmelina, For 2025, the standard deduction amount has been increased for all filers, and the amounts are as follows.

2025 Tax Brackets Married Filing Jointly With Partner Illa Paolina, The additional standard deduction for people who are 65 or older is $1,950 for single filers or heads of household, and $1,550 for married couples filing jointly.

2025 Standard Deduction Married Jointly Over 65 Bert Marina, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

Standard Deduction 2025 Married Jointly Single Veda Allegra, If you're married, filing, jointly or separately, the extra standard deduction.

2025 Standard Deduction Married Jointly Over 65 Bert Marina, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.